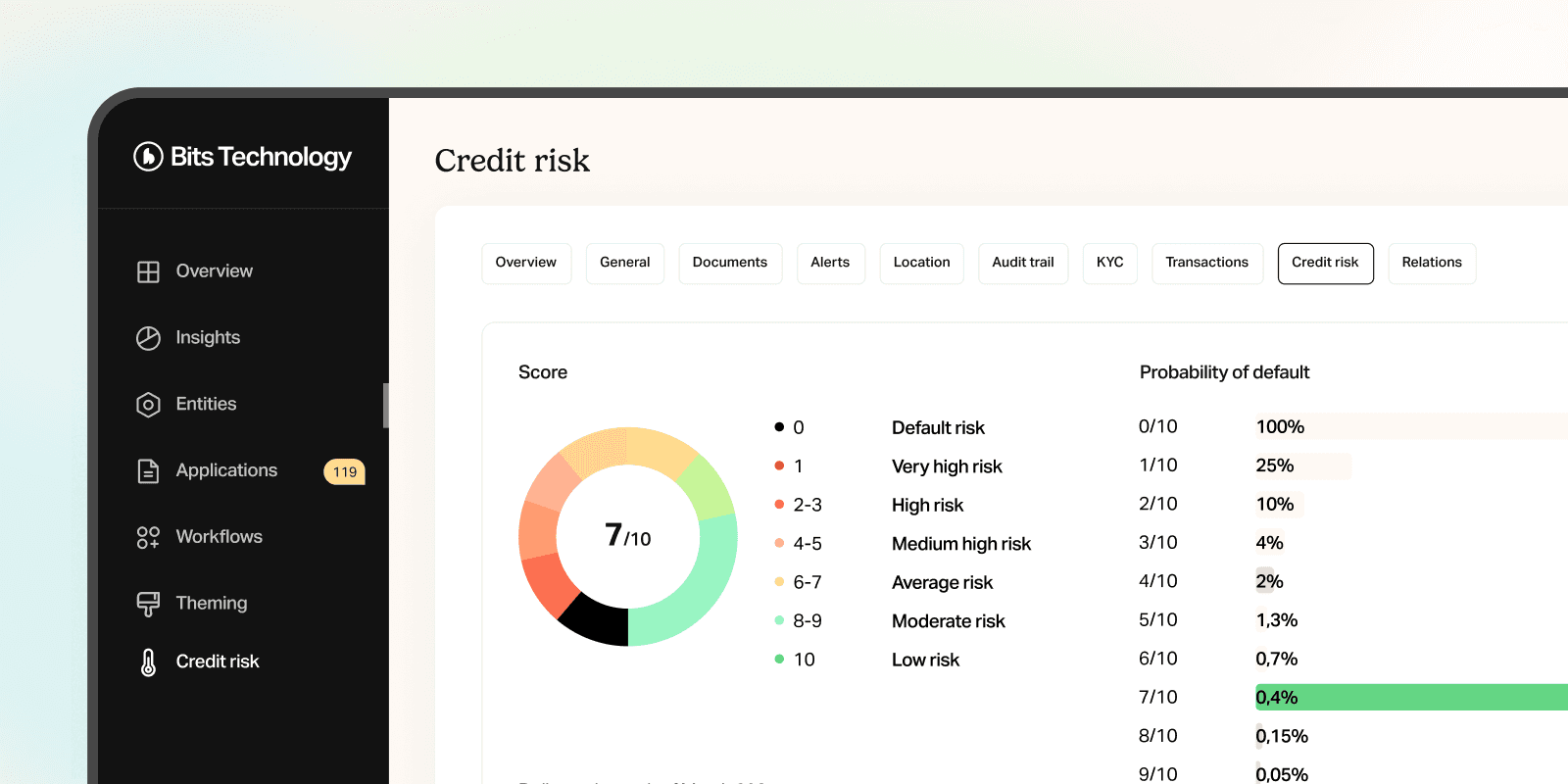

Scaled credit assessment score.

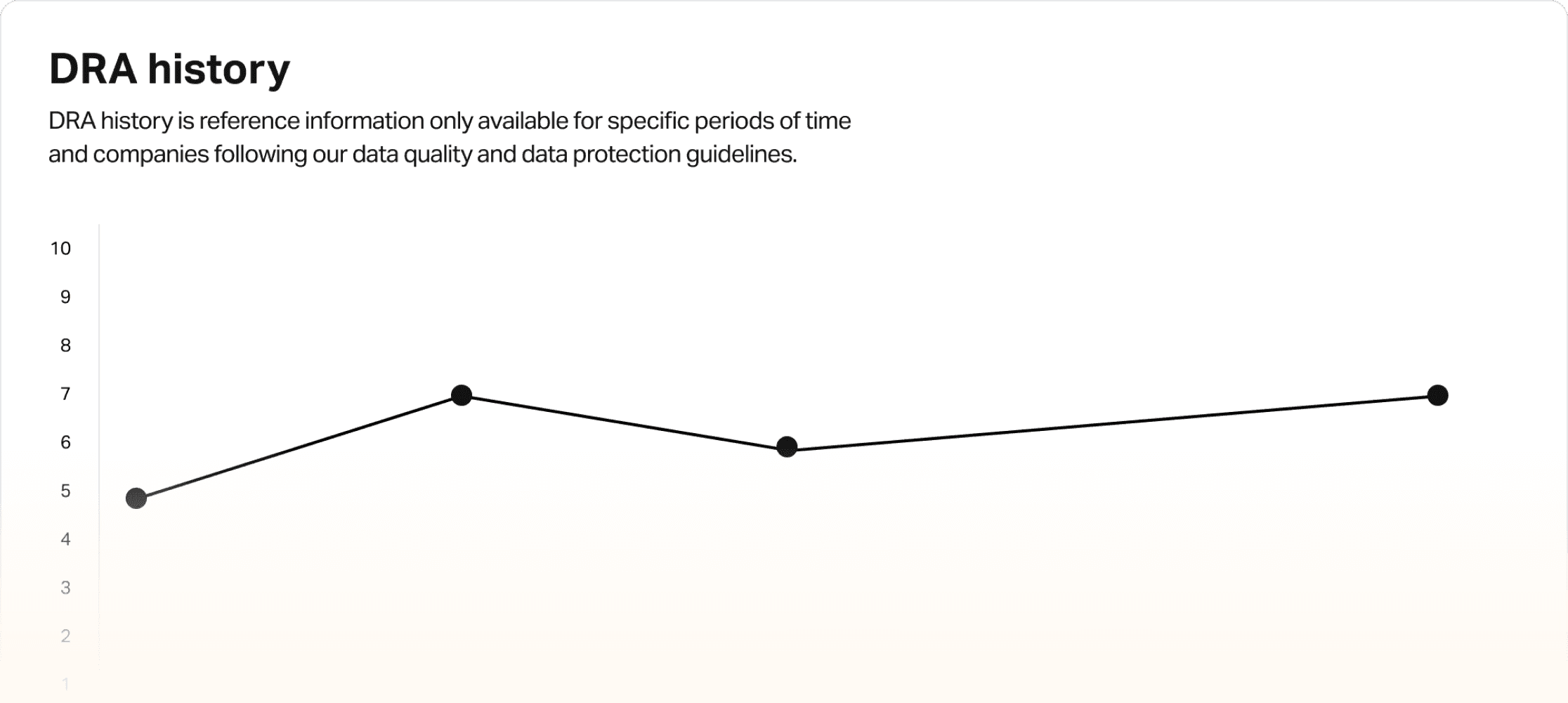

History evolution past 5 years

Probability of default per class

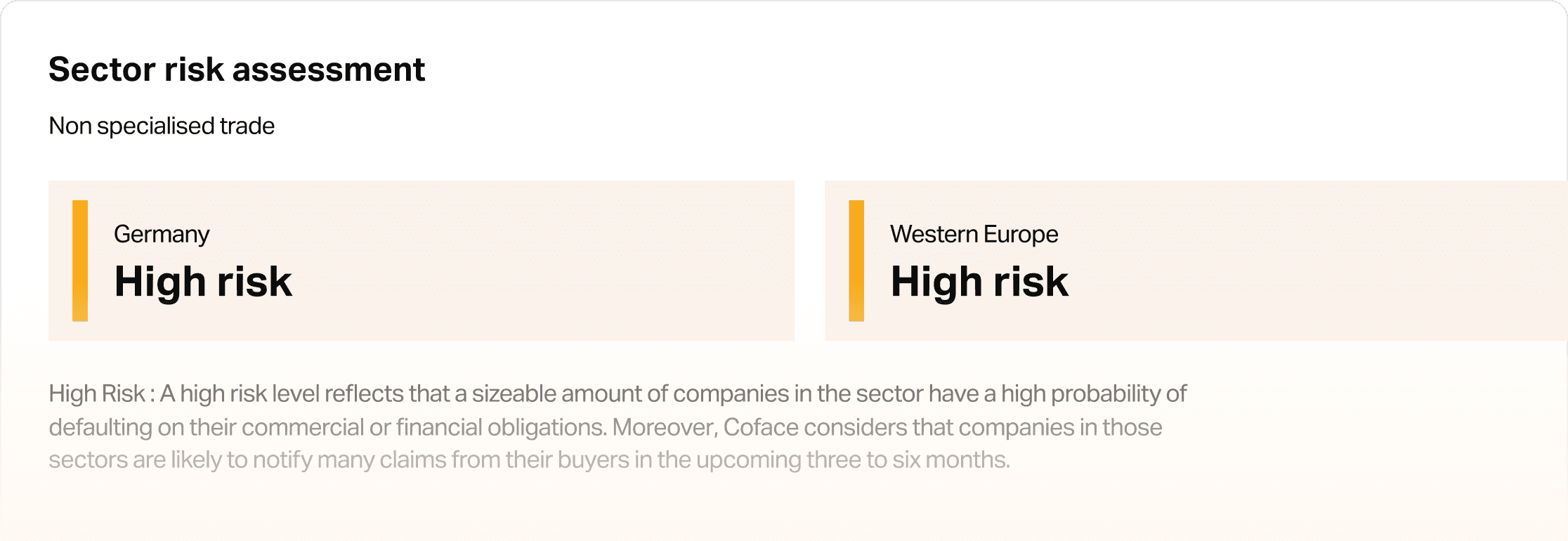

Worldwide risk assessment

Detailed reports

The Debtor Risk Assessment is the likelihood over a period of 12 months, that a company will be able to honor its financial commitments such as counterparty obligations. It is calculated on the basis of typical financial attributes that include financial soundness, profitability, Coface payment experience and claims, and solvency ratios as well as qualitative data such as the company's current business environment and management.

Global, yet market specific

Access to a worldwide risk assessment with Monitoring wherever you need it.

Take action based on data

Credit Risk assessment score of the company based on a unique scale (from 0 to 10).

Take informed decisions

History evolution of the scores during the last 5 years (if available).